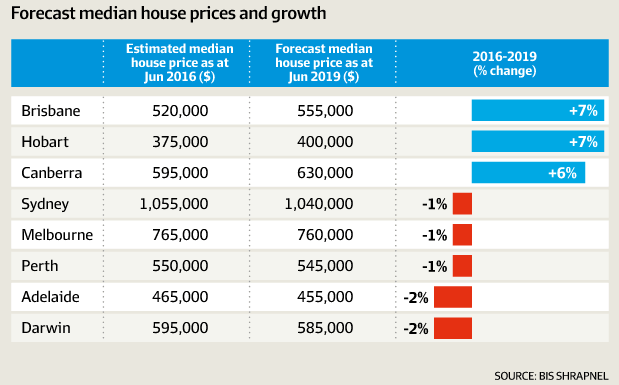

According to a major economic and construction forecasting agency, home prices across Australia will fall in real terms over the next three years. Years of property price rises has seen the median house price in Sydney and Melbourne increase to $1,055,000 and $765,000 respectively but BIS Shrapnel has forecast that the ‘bull run’ is over.

Overall, they’re predicting that homes in Sydney, Melbourne and Adelaide are subject to falls of two per cent in nominal periods between 2016 and 2019. There also appears to be a growing disconnect between detached housing and the apartment market with apartment values tipped to fall at double the rate predicted for detached homes. And analysts are questioning whether rental demands are strong enough to match supply.

The forecast

Sydney’s median apartment price is predicted to fall by up to five per cent by 2019, while Melbourne’s apartment prices could fall by as much as eight per cent, citing increasing supply, tighter banking restrictions, slowing population growth and reduced investor demand as the cause.

Despite their data being predominantly negative, they’re not convinced the market is going to crash, which some media outlets would have you believe. Another independent research provider, Morningstar, agrees with this sentiment for a number of reasons:

So what does this mean for you?

While individual opinions regarding the future of the residential property market varies, collectively, we agree the market is unlikely to crash but may experience a prolonged period of flat to modestly lower prices – five to seven years.

If you are investing in property, or are relying on your property for capital or income, it is critical to have a good understanding of the process of price variations and monitor your investments.

Disclaimer: It is important to note that forecasts are based on current and emerging trends. The future property market indication by BIS Shrapnel is only a prediction, and not a certain prospect.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.