Will it or won’t it? Following recent reports that property prices in Australian have increased at their fastest pace in seven years, various media outlets have been questioning whether these increases are sustainable. Speculation regarding the bursting of the property price bubble is rife.

A media release from Corelogic revealed that house prices in Sydney increased by 18.9 per cent – the fastest rate of growth in almost 15 years: while prices in Melbourne grew 15.9 per cent over the past year.

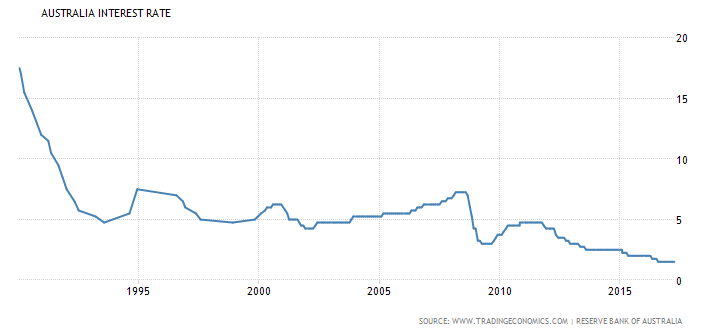

The so called property market boom has been largely fuelled by historically low interest rates (refer to below chart), population growth (now almost double the global average), changes to foreign investment rules and supply shortages.

There are several indicators that suggest that Australian market is extremely overvalued:

What could be the catalyst for the bubble to burst?

One of the main drivers of property prices is interest rates. When rates are low, affordability increases, resulting in greater demand and higher prices. However when rates begin to rise, the cost of servicing debt will increase and may place many homeowners in mortgage stress. And it’s not just owner-occupiers who will hurt. Investors will see the gap between interest costs and rental income widen. Both factors are likely to reduce demand and may even force sales.

The other issue that we are particularly concerned about is the impending oversupply of apartments. Australia currently has around 220,000 yet to be completed apartments worth an estimated $35 billion. In addition, a report from BIS Oxford Economics showed that 50 per cent of new apartments bought and re sold in the five years to 2016 in Melbourne sold at a loss.

What would a downturn look like?

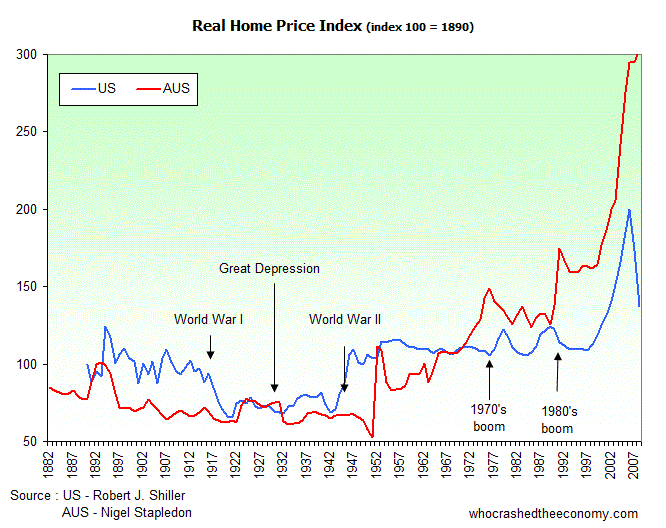

Although a common school of thought is that property prices only ever go up, there have of course been falls in the market throughout history. As highlighted in the below chart, Australia has experienced five residential property bubbles over the past 135 years. In real terms, house prices fell 9 per cent between 1989 and 1992, 17 per cent between 1974 and 1979 and 27 per cent following the 1950 bubble.

Where to from here?

While the above chart may be cause for alarm when considering the exponential spike in prices since the late 90s, we are by no means predicting an Armageddon scenario. It is important to note that since 1955 the average peak to trough decline in Australia has been around 10% and typically, a property correction comes in the form of three to six years of price stagnation. Aside from the inner-city apartment market, where we expect a major correction, it is our belief that a minor correction followed by a period of nominal growth is the most likely outcome.

How can Hewison Private Wealth help?

As always, our advice is to ensure you have an adequately diversified portfolio, which could minimise the impact of a downturn in any asset class. In addition, having adequate safeguards in place to mitigate against rising interest rates and/or period of property vacancy is always prudent.

If you’d like independent financial advice, specifically tailored to your personal situation, please contact us. Hewison Private Wealth are specialists in financial planning, investment advice and self managed super fund (SMSF). Reach out to a qualified independent adviser on 03 8548 4800, [email protected] or visit www.hewison.com.au

The information provided above is general information only. It does not consider your needs, financial situation or objectives. You should seek specialised advice from a qualified financial adviser.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.