When the price of Bitcoin surged past US$6,000 people began to ponder not only the future of crypto currencies but the future of money altogether.

Before we go further, let’s start with a brief history lesson on money:

What is a crypto currency?

Crypto currencies, like Bitcoin, are digital currencies that allow you to send money over the internet via a peer to peer system. It is a decentralised system and is not controlled by central banks or governments but rather by “miners”, who are rewarded by earning Bitcoin for verifying transitions.

All transactions are recorded in a transparent public ledger known as the blockchain. The software behind Bitcoin is open source and accessible by the public.

Bitcoin is attractive for many users as it’s instantaneous and there are no fees or commission that erode value, as is experienced when converting one currency to another. Whilst the price of Bitcoin can be volatile due to supply and demand factors, its value cannot be impacted by government intervention such as printing money, which can cause inflation and effectively devalue the worth of your money.

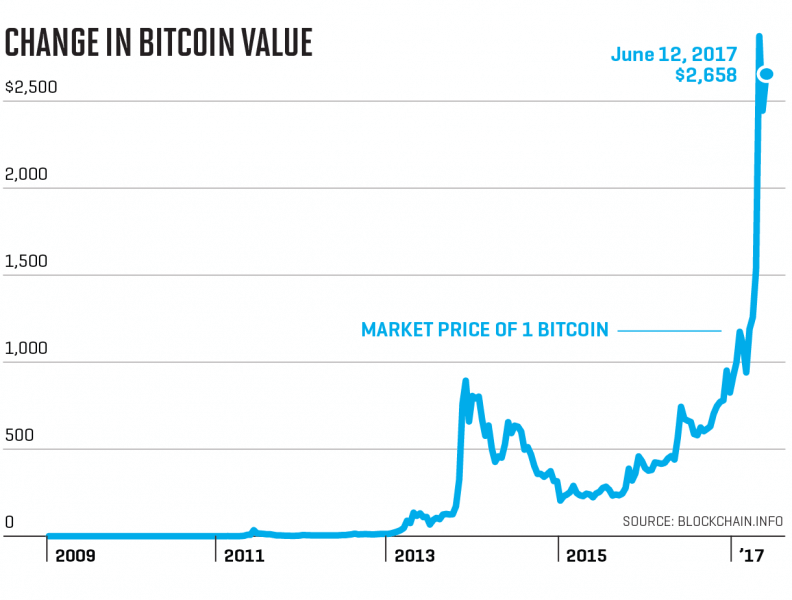

The price of Bitcoin has soared in recent times. See the graph below showing its movement since inception in 2009:

Bitcoin’s initial value was effectively zero upon its creation in 2009. Its highest price in 2010 was US$0.39. If you had of purchased $100 worth of Bitcoin at this time it would now be worth over $1.5 million US dollars.

Bitcoin has been a volatile currency in its short history. In late 2013 it fell from around $1,200 to a low of just over $200, a fall of over 80%. Even this year, when China restricted the way Bitcoin could be used, it fell over 30%.

However, Bitcoin has been on a tear this year. On 1 January its price was around $1,000 and today it sits at around $6,000.

Here are my thoughts on Bitcoin:

But as an investment I caution people:

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.