How much money do you need to live the lifestyle you desire in retirement? Retirement planning is not an easy sum to calculate. And many people underestimate the amount they’ll need to see them live comfortably.

You’ve worked for decades and enjoyed a regular income. It can be daunting to think of a time without regular income appearing magically into your bank account.

The Association of Superannuation Funds of Australia (ASFA) has researched the costs that most retirees encounter. ASFA has looked at the income required for a “Comfortable” standard of living, as well as a “Modest” standard of living.

See below for people aged around 65:

|

|

Modest Lifestyle |

Comfortable Lifestyle |

||

|

|

Single |

Couple |

Single |

Couple |

|

Total per year |

$24,270 |

$34,911 |

$43,695 |

$60,063 |

Source: ASFA Retirement Standard, updated to June 2017

For those aged over 85, the figures are:

|

|

Modest Lifestyle |

Comfortable Lifestyle |

||

|

|

Single |

Couple |

Single |

Couple |

|

Total per year |

$23,878 |

$35,369 |

$39,443 |

$55,382 |

Source: ASFA Retirement Standard, updated to June 2017

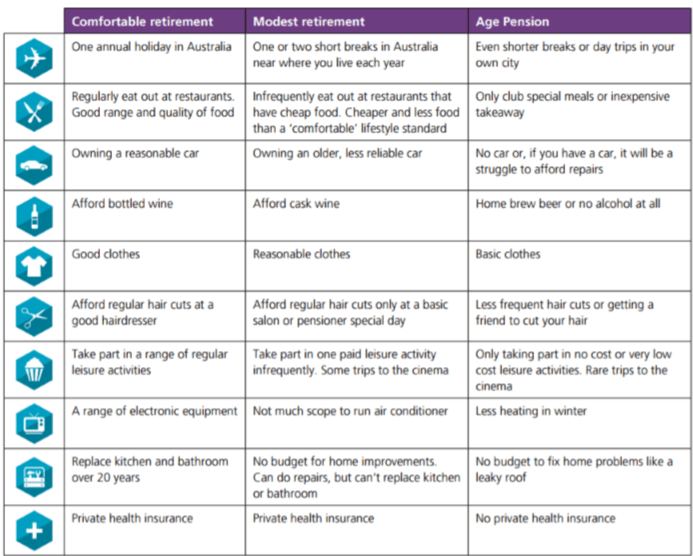

But figures alone rarely tell the whole story. You need to understand the costs that underpin these figures to get the full picture.

The below table provides some more detail around the lifestyle that such incomes would support:

If you’ve caught the travel bug or if you own multiple residential properties, like a holiday home, the amount of money required to meet your lifestyle will be even greater.

So, if you’re nearing retirement what does this mean?

The answer is….it depends…

If you wish to keep hold of your capital and pass that to the next generations you will need to ensure you have enough money invested to live off only the income. A good rule of thumb in this case is to multiple your desired income level by a factor of 20. Invested wisely, this level of capital should provide income to meet your needs, as well as some growth to offset the longer-term impact of inflation.

The table below provides the capital amounts needed by those around 65 years of age to provide income in line with the ASFA Retirement Standard:

|

|

Modest Lifestyle |

Comfortable Lifestyle |

||

|

|

Single |

Couple |

Single |

Couple |

|

Total per year |

$485,000 |

$700,000 |

$874,000 |

$1,200,000 |

The final piece of the retirement funding puzzle

The future costs of aged care. Using only the income generated by your investments to meet your retirement living costs leaves the capital intact to access later. Certainly aged care costs would be a use for your capital at that time.

Not all people can accumulate sufficient capital to meet their needs from investment income only.

If you have insufficient capital to meet your desired income level without drawing capital, then the critical issue becomes how long your money will last, which depends on your life expectancy.

Understanding the relationship between asset values, income generation, government support via the age pension, and the issues associated with longevity are all in the remit of a financial adviser.

Where to from here?

If you are concerned about your ability to fund your retirement, or wish to make sure your assets will produce the income you need to fund your retirement, please contact a Hewison Private Wealth financial adviser.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.