There’s no doubt about it, Australian property prices have experienced strong growth over the past 20 years or so. Unfortunately, the higher prices are making the dream of home ownership less likely for many Australians.

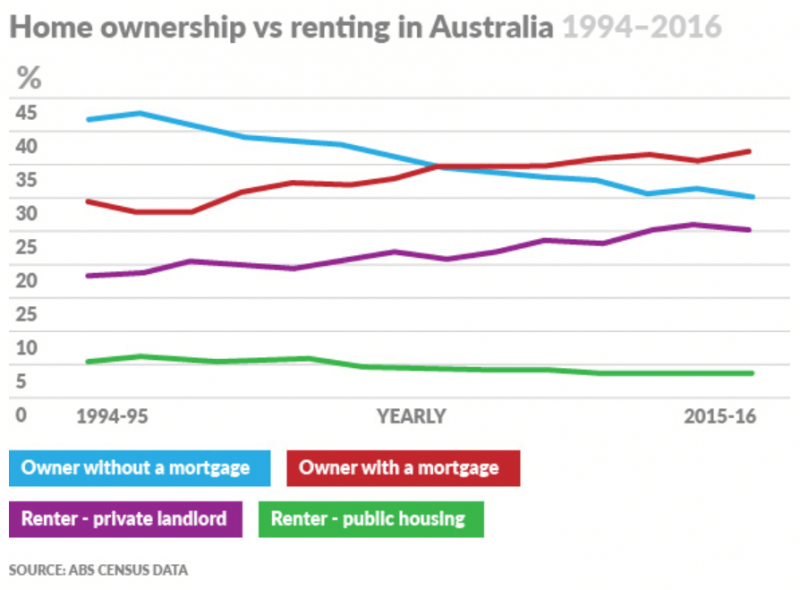

Stronger property prices have shifted the dynamics when it comes to home ownership. The percentage of home owners is falling and the proportion of renters is increasing. Not only is there a shrinking percentage of home owners, those that do “own” their own home are more likely to have a mortgage than ever before. Put simply, less people are owning their own property and if they do, they are taking on more debt.

This is reinforced by Australian Bureau of Statistics data. In 1994 renters made up around 18% of the housing market. By 2016 the percentage of renters in Australia reached 25%.

Prices rising at a faster pace than rents have resulted in fewer renters taking the plunge and entering the property market. Those that do manage to purchase a home are having to take on more debt, taking much longer to repay this debt and sometimes even entering retirement with a mortgage outstanding.

A drop in property prices could result in more buyers and see a reversal of falling home ownership. And this year we have begun to see a cooling off in the property market, particularly in Sydney and Melbourne. If housing prices continue to abate it’s possible we will soon see more first home buyers enter the market.

I still like to think that the dream of home ownership in Australia is alive and well. I would encourage anyone looking to purchase their first property to do their research and build a big enough deposit so you are not putting pressure on yourself when making loan repayments. Also consider the very real possibility of rising interest rates and the impact that may have on your loan repayments.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.