Last Sunday night, the 60 Minutes program on Channel 9 aired a segment on the Australian property market titled “Bricks and Slaughter”. If the headline isn’t alarming enough, the report claimed the Australian property market could fall as much as 40% to 45% within the next 12 months.

Several extreme comments were made on the program, such as “get out while you can” and it’s going to “fall off a cliff”.

My first issue with this program is that it is sensationalist reporting. Fearmongering sells papers and grabs headlines. Not all people share the view that the Australian property market is going to have such a big fall. It would have been nice to have someone on the program with a counterview to provide a more balanced opinion.

The problem when making claims about the direction of the ‘Australian property market’, is it’s such a big market. Within this market there are many states, cities and suburbs all performing differently.

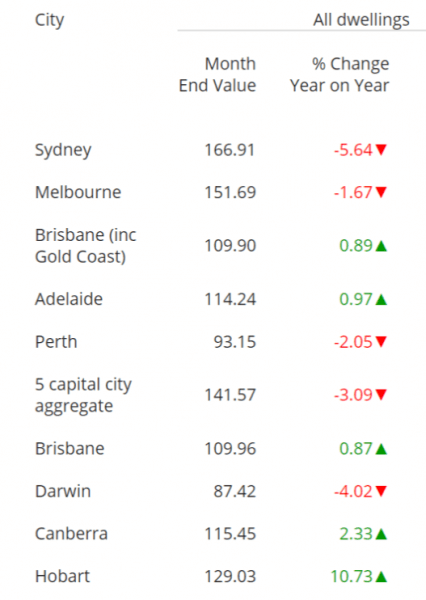

(Scroll to the end of this blog for a table showing the percentage year on year change for all major Australian cities to 31st August 2018.)

The 60 Minutes program honed in on the Western Sydney market with a local real estate agent suggesting a recent 20% decline in prices within that area. The program conveniently selected a suburb in Western Sydney that has suffered a recent decline. But what about the markets in Australia that have seen an increase over the past 12 months? According to CoreLogic data Hobart has seen an increase of 10.7% over the last 12 months.

The program then went on to interview people in the unfortunate position of suffering mortgage stress. One due to illness and another due to lack of employment. Mortgage stress is real but factors such as illness or unemployment will cause mortgage stress regardless of the state of the property market.

Lastly the report made comparisons of the Australian market now to the US market of around 10 years ago, when it suffered significant falls. The Australian market is very different to the US market on several fronts. The obvious difference is the non-recourse nature of loans in the US. Borrowers were obtaining finance with no deposit and given the non-recourse nature of their loans, property owners could simply hand back the keys and leave it to the bank to pick up the mess.

As the data suggests, there is no doubt that in some states, in particular Melbourne and Sydney, the property market is cooling. It is not uncommon for the property market to suffer declines over shorter periods of time, especially after periods of strong increases, which has been the case for the Melbourne and Sydney markets in recent years. How far the market will fall? That is anyone’s guess.

Don’t make rash decisions on the back of alarmist media articles. Understand the market you are invested in and make measured decisions on the back of that. I would always encourage people to seek professional financial advice to help guide investors to make the right decisions. If you would like to speak to an impartial financial adviser please get in contact with me.

Part one and two of the 60 Minutes program can be seen here:

Part 1 ~ Part 2

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.