It was not that long ago that some pundits were reporting Australian’s were facing a 40% fall in house prices. In my view, extreme headlines like this plastered across media outlets over and over again are motivated by ‘selling’ news and attracting attention.

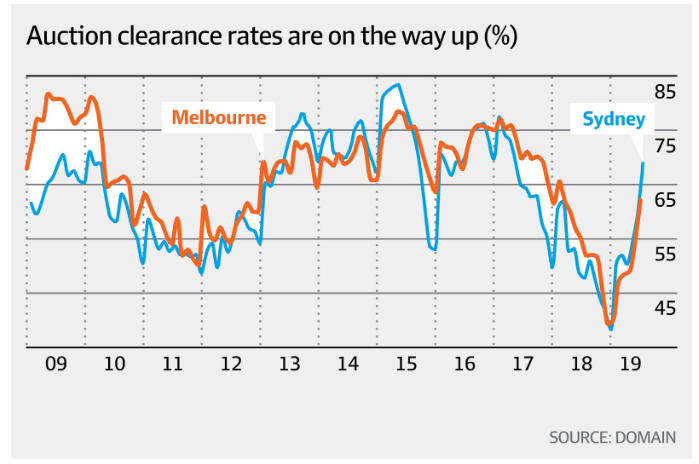

In contrast to this, I was very pleased to see the past weekend’s preliminary auction clearance rates of 79% in Sydney and 76% in Melbourne. It was a very different story this time last year when both markets were in the midst of a downturn and just 49% of properties sold in Sydney and 54% changed hands in Melbourne, according to Domain Group data. Data released by CoreLogic Inc. on Monday showed Australian housing prices rose the most in almost 2.5 years in the month of August.

This reminds us all that things are never as bad or as good as they seem; a particularly important lesson to remember when it comes to investing.

For starters, money is cheap and likely to get cheaper. The RBA has recently cut the cash rate twice by 0.25% from 1.5% to 1.0% with economists expecting more reductions to come.

Also, APRA has loosened their grip on the banks’ in turn giving permission to increase lending. Thirdly, today’s buyers are keen to take advantage of recent price falls. But there’s more – employment is on the rise, the election is over and Labor’s concerning policies targeted at negative gearing and a lower capital gain tax discount are out the window.

Sentiment has risen so sharply, that CoreLogic research director Tim Lawless now says the rebound could potentially turn into a ‘V-shaped’ recovery.

At this stage, probably not much. Although the recovery may become very real if the present trajectory continues throughout the peak Spring selling season as more supply hits the market. But not everyone is convinced the property market has bottomed – time will tell.

If the worst is behind us in the property market and prices stop dropping (possibly even start to rise), this should make consumers feel wealthier and hopefully spending increases as a result. If consumers don’t come to the party and choose to pay down debt rather than increase discretionary spending, the RBA could be backed into a corner of lowering rates; further supporting property prices as a result.

Making predictions is a futile exercise and what’s even worse is basing investment decisions on guesswork. We strongly advocate building a well-diversified portfolio with a long term time horizon in order to weather storms and take advantage of opportunities during turbulent times. It’s easy to become trapped in thinking the current situation is how things are going to be forever, but in this rapidly evolving world it pays to remember that things are never as good or as bad as they seem at the time; especially when it comes to investing.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.