Whether you’re looking to kick start your investment journey or have been investing for many years; I’d like to share a few tips that could help you build a more resilient portfolio.

Before making any investment decisions, it’s important to understand what you’re trying to achieve. Are you looking to grow your wealth or looking to build a portfolio to assist with income generation to fund your retirement?

Without understanding what your goal is, it is difficult to put a plan in place to help you achieve it. Many investors fall into the trap of investing in different products over time without really knowing why.

Once you have identified your goals, investing is not particularly complicated if you stick to the following principals:

Investing inherently comes with risk, the key is to manage the risk. Generally speaking, the higher the return, the riskier the investment. Many investors are focused on chasing returns and forget to consider the risks involved. It is often too late to back out once you identify your mistake.

As a responsible investor, you should always ask yourself “how much could I lose and am I comfortable with that?” The answer to these questions will help guide you towards making better investment choices that are in line with your risk appetite and ultimately what you want to achieve.

Most of us know that putting all your eggs in the one basket is not wise. That’s why diversification is so important. Ideally you should be looking to secure a range of investments in different asset classes to mitigate risk.

Should you ever receive advice to invest a large proportion of your wealth in a single investment, my advice is to walk away or seek a second opinion. All it takes is for one bad investment for you to lose all the money you have worked extremely hard for.

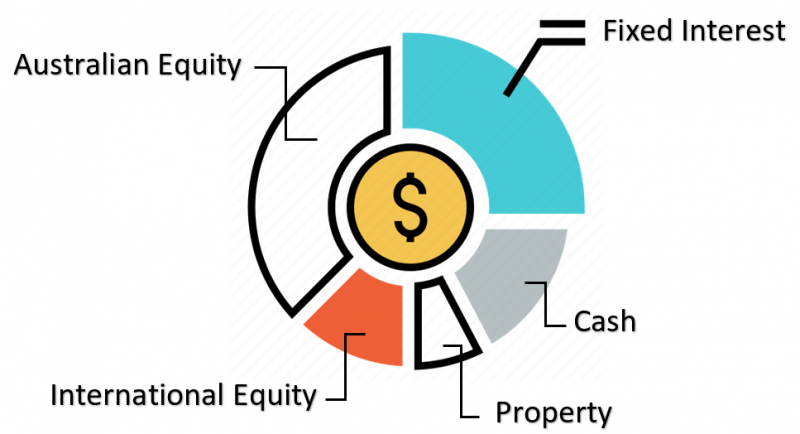

Asset allocation is the spread of your investments across different asset classes – just like the diagram below.

It’s important to put an appropriate asset allocation in place that is in line with your objectives and risk appetite. It is a key determinant in investment performance outcomes and the level of risk you hold. This asset allocation generally stays the same unless there is a change in your circumstances.

In an ideal world, we want to invest our money in asset classes that will perform well. However, the bad news is – no one has a crystal ball.

We can rely on advice from experts but no one really knows what the share market will do or when the property market will rally. Spreading your investments across different asset classes provides you with exposure to the wider market and helps reduce risk through diversification.

When markets move, asset prices change. This may result in your portfolio drifting away from its target asset allocation. Rebalancing is the act of adjusting your portfolio back to your target allocation.

The key benefit of rebalancing is that it removes any emotion out of the equation.

For example; the Australian share market has underperformed and the proportion of Australian shares in your portfolio has dropped. Without an asset allocation, we are more likely to not do anything or sell down to prevent further losses. However, asset allocation will force you to buy more Australian shares when prices are cheap. This is also the act of buying low and selling high.

These are some of the few investing principles that we believe in at Hewison Private Wealth and that have helped our clients ride through different market cycles over the last 30 years.

I hope you have found them helpful and if you have any questions, please reach out, I’m happy to answer your questions.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.