The global outbreak of the Coronavirus has seen wild swings within investment markets, as investors try to predict the impact that the virus will have on global economies.

In February 2020, the Australian share market hit an all-time high but has since reduced around 10-15%.

While it is human nature to concentrate on the 10-15% fall, at times like this we need to take stock and look at the situation over the longer term; remembering that the share market has increased over 35% in value over the last four years – including this recent bout of volatility.

Whenever markets have a period of sustained growth, investors tend to go looking for reasons for a correction to occur. It is an unfortunate reality of human nature.

The period August to December 2018 saw a 14% decline in the Australian share market, due to increased tensions of a Trade War between China and the United States.

While tensions around the Trade War lasted much longer than this five-month period, eventually the share market saw sense and began a recovery. This recovery set the market up for a 25% increase over the 2019 calendar year.

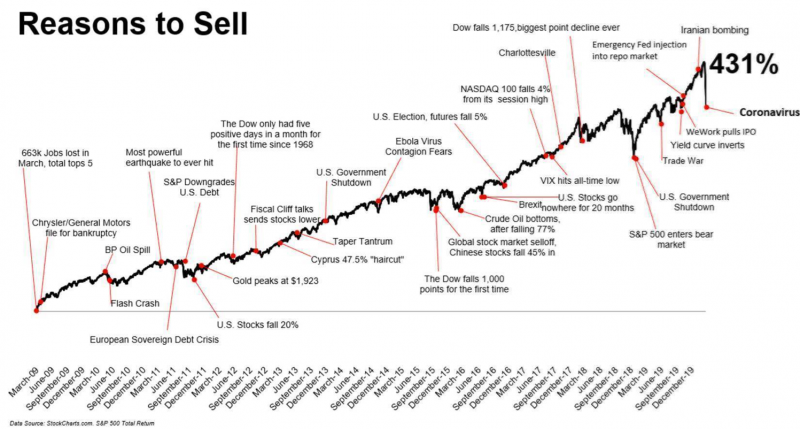

History is littered with similar examples to this (e.g. US Presidential election, Brexit). 2016 saw the share market reduce 10% in value over January and February, only to recover 20% for the rest of the year. The below image further highlights these events and others since the GFC.

Global events that affect the economy can cause volatility across all markets, not just the share market, however; the share market tends to be where the media focus because companies are priced live through the various stock exchanges. Price fluctuations are happening within property markets also, it‘s just we cannot see it as easily.

It’s too early to understand the extent that the Coronavirus will have on the economy, so what action can we take to protect portfolios?

Well, as a Hewison Private Wealth client, your adviser will have recommended a diverse investment strategy across asset classes and within the asset class itself. Depending on your goals, it’s likely your portfolio will be underpinned with consistent and reliable cash flow in the form of dividends, rent and fixed income. Based on historical experience, regardless of asset value fluctuations, day to day cashflow should vary all that much, if at all.

With that said, there should be no need to panic. The best strategy is to stay the course of your long-term investment strategy and if the opportunity presents itself, take advantage of longer-term opportunities if recommended by your adviser.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.