As the community and government response to COVID-19 escalates, there has been a wide range of assistance programs released over the past week and updated over the weekend.

Some of the assistance is targeted specifically at individuals and families, while other measures are targeted to help businesses cope with pandemic related hardship. Upon reading the following summary of the government assistance announced to date, as of 22nd March, we strongly recommend contacting your adviser if you would like to clarify any of the measures, and whether they may relate to you:

The following is a summary of the assistance being provided by the Federal Government to individuals and families. More information can be found at https://treasury.gov.au/coronavirus/households .

Income support for individuals:

Payments to support households:

The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession cardholders. The first payment will be made from March 31, 2020 and the second from July 13, 2020.

Eligible individuals will be able to access up to $10,000 of their superannuation before 1 July 2020 and a further $10,000 from 1 July 2020 for approximately three months.

To be eligible, you must:

Applications can be made from mid-April.

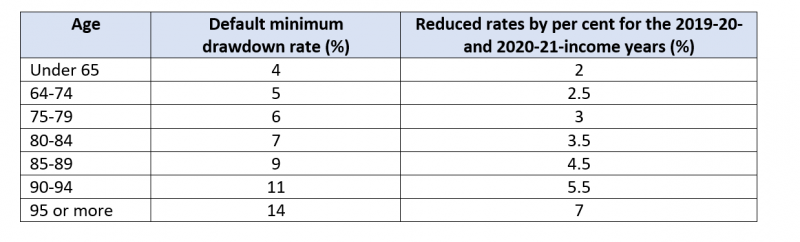

For those who are drawing a pension from their super fund, the minimum required pension for the 2019-20 and 2002-21 financial years is being reduced by 50%. The table below summarises the change:

The deeming rate for financial assets for those on social security is being reduced from 1 May 2020. The upper deeming rate will reduce to 2.25% (from 3%) and the lower deeming rate will reduce to 0.25% (from 1%).

The following is a summary of the assistance being provided to businesses by the Federal Government. More information can be found at https://treasury.gov.au/coronavirus/businesses

Support from the Victorian Government

The Victorian Government has also announced a series of programs to assist Victorians to deal with coronavirus related issues.

Under an announcement on Sunday 22nd March, the Victorian Government will provide emergency relief packages to Victorians self-isolating due to COVID-19 with no access to food and essential supplies.

The program is to support those in mandatory self-isolation, who have little or no food, and no network of family or friends to support them.

Each eligible household will receive a two-week supply of essential goods.

The emergency relief program will be coordinated by the Red Cross in partnership with Foodbank Victoria and will start from Monday 23rd March.

Those not eligible for the emergency relief packages are encouraged to be self-reliant and call on the help of family and friends wherever possible.

Those wishing to access the program should call Victoria’s dedicated coronavirus hotline 1800 675 398.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.