As we have emerged from the pandemic-led lockdowns, the performance of the residential property market since Spring 2020 seems almost unbelievable.

The number one question everyone is asking…when is this bubble going to burst?

But here is one from left field; when is a property bubble, not a property bubble?

Property is a unique asset class in that individual properties are not valued everyday week or month, unlike share markets. Therefore, we do not see the fluctuations that are occurring based on weekly sale prices and auction clearance rates, let alone reserve bank comments on interest rates. As we know, a simple AFR headline can impact the share market, day by day.

The average home price rose by 8.1% in the previous 12 months, according to CoreLogic. That said, between March 2018 and March 2021, median home values rose 5.7% (Sydney) and 2.2% (Melbourne) respectively.

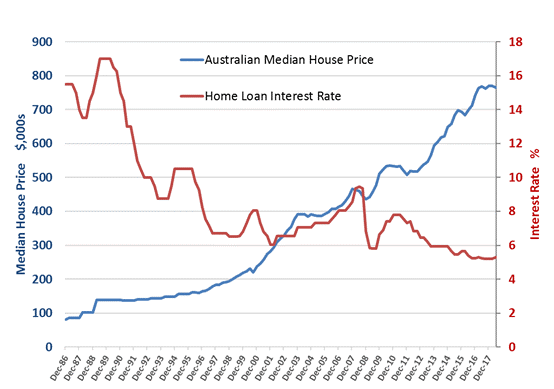

Perhaps nothing? Rising interest rates occur to slow a healthy economy (inflation) which would indicate the rising wealth of consumers and as the graph below illustrates, property markets can still grow with rising interest rates.

I do get a sense that interest rates will eventually put the brakes on the property market. Although the banks do their due diligence on affordability at higher rates, I fear that many borrowers will feel the pinch when rates begin to rise.

I also get a sense that rates will rise sooner than currently predicted in 2023. Furthermore, the banks can begin to adjust their home loan rates sooner than the RBA can raise the cash rate.

Long-term investors shouldn’t necessarily be concerned with when they buy in the cycle. However, unlike share investing, where it’s easy to sell or buy smaller parcels depending on market conditions, property is a lumpy asset. Property owners can’t simply add a new bedroom at a lower price if the market falls.

To best answer this question, it depends on the purpose of the property purchase:

A family home should not really be considered an Investment. The interest is not deductible and the intention is to enjoy the property as a lifestyle asset. Therefore, one should be more concerned with their ability to make the repayments at long-term average interest rates (think something with a 7 in front of it!), as opposed to where we are in the property cycle.

For investment purposes, I would advise looking for an asset with value add possibilities. Therefore, even when purchasing at the top end of any cycle, you can continue adding value to the asset. Think worst home on the best street, and/or a property that can be renovated without making structural changes requiring arduous council approvals (something I have just gone through myself).

Holiday homes are a mixture of the above. Typically they are for lifestyle purposes but commonly rented out which makes the asset an investment.

Again, one should be less concerned with the property cycle and more concerned with the ability to make interest rate payments along with the quality of the asset for letting purposes. Something with value-add potential never hurts either.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email [email protected] or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.