If you have Income Protection or Salary Continuance insurance, you’ve probably experienced a significant increase in your premiums during the last few years regardless of which insurer you’re with.

APRA released a report on 16 December 2022 regarding the sustainability of individual disability income insurance (IDII). IDII have been provided by life insurance companies in Australia for decades and provides policyholders with a percentage of their income if they cannot work for prolonged periods due to injury or illness.

Intense competition between insurers, higher claims (including duration as some policies can pay out to your age 65) and lower insurance affordability have resulted in a prolonged period of losses that have significantly challenged the sustainability of the IDII product. APRA stated that in the 5 years to 2019, the collective losses from IDII across Australia total $3.4 billion.

To address these concerns, APRA began implementing a series of measures in 2019 with the aim of securing the affordability and availability of IDII into the future, which includes a great stability of premiums over the long-term. These included changes such as the removal of Agreed Value definitions for new IDII policies as well as reducing the maximum income replacement ratio (the percentage of your employment income you can insure) from 75% to 70%.

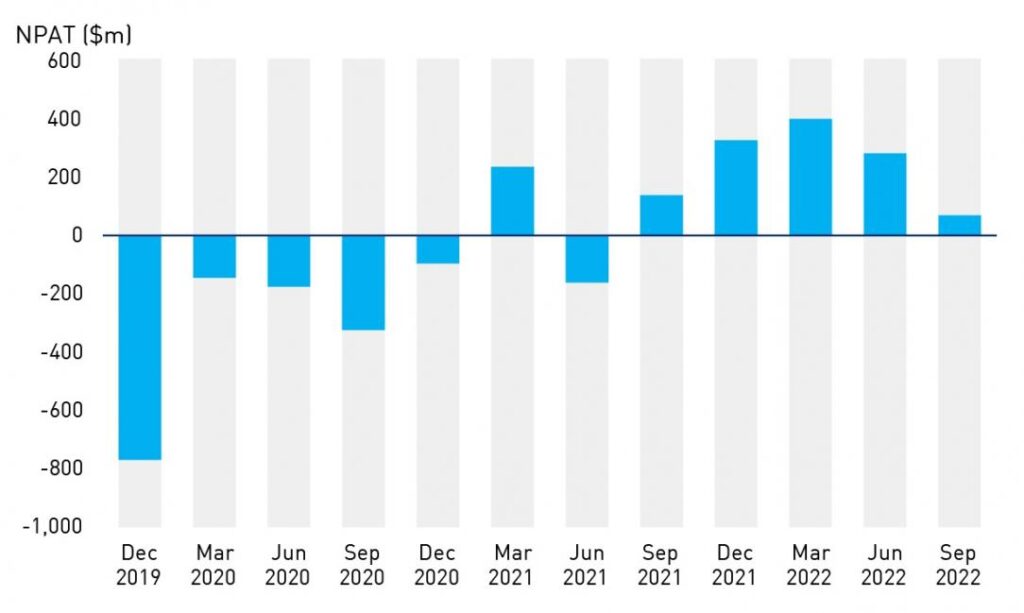

Since September 2021, Australian life insurers reported net profits after tax (NPAT) for five consecutive quarters after experiencing mainly net losses.

Insurers hold reserves for both current and expected claims and expenses. When these reserves surpass future premiums, it means the insurer expects to make future losses. Insurers are required to recognize these losses immediately and ensure they hold additional capital to meet expected claims.

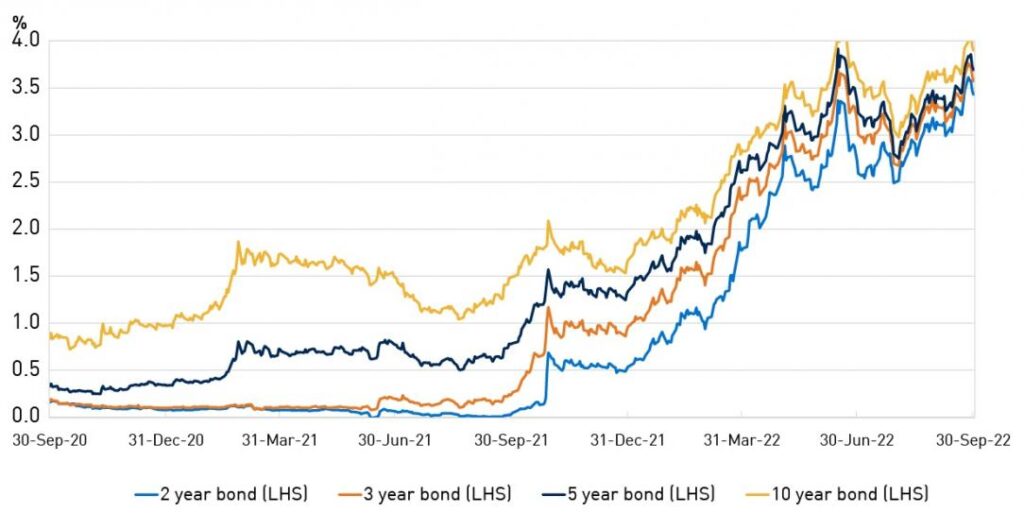

One of the reasons for the improving outlook for IDII has been the increasing Australian government bond yield. Insurers depend on the stable and predictable returns from government bonds to help manage financial risk and meet their obligations from insurance claims.

As government bond yields have been increasing, this means the future liabilities of insurers can be discounted at a higher rate which reduces the liabilities’ value, and thus improving the insurer’s profitability. However, increasing bond yields also affect the bonds already held by insurers as they are also discounted a higher rate, which reduces their value. This results in life insurers experiencing unrealized losses on the bonds they hold, which negatively impacts profitability. As per the below chart, in the March-22 and June-22 quarters the reduction in net policy liabilities exceeded the investment revenue losses.

There is potential for the 10-year bond yield to return to a lower level over the next few years partly due to increased interest rates, which started to occur in the September-22 quarter.

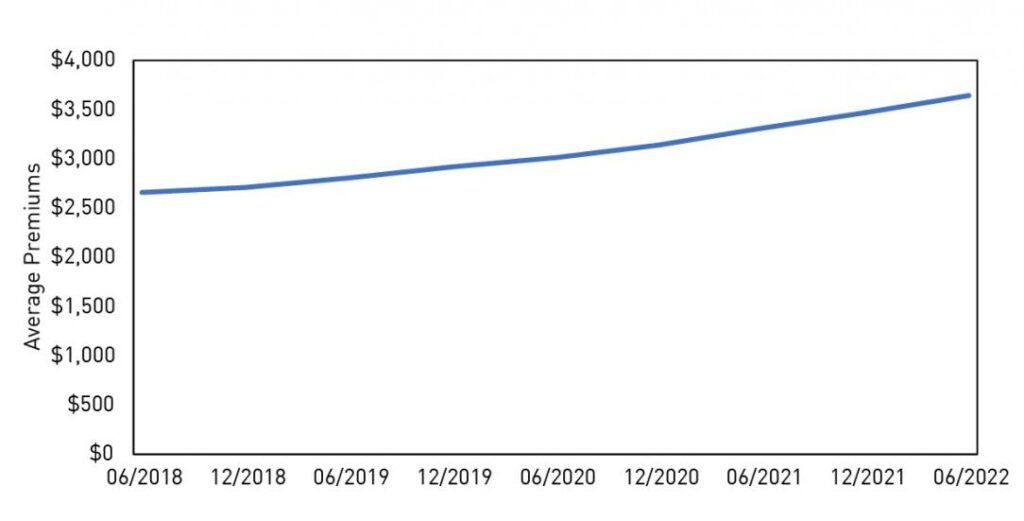

Premiums are crucial for an insurer’s profitability, so repricing is another element that contributed to improved results for IDII products recently. When a life insurer reprices policies, it can make releases from the reserves it maintains for expected claims.

Chart 4 shows the continued increase in average premiums due to various repricing activities across the industry. Unfortunately, repricing is expected to continue for some time as many insurers still expect future losses from their current IDII portfolios to rise. This makes it even more important to ensure you review your policies with your financial adviser if you are having concerns about affordability. There are many strategies advisers can use to reduce your overall premiums, and it is always better to look at these options rather than being without any Income Protection insurance.

APRA expects that the new IDII products that have been launched since 2019 should assist with stabilizing premiums over the long-term.

During the early stages of the pandemic, insurers set aside increased reserves due to anticipating a spike in claim costs related to COVID-19. COVID-related claims have fortunately been lower than expected due to Australia’s approach over the last few years including lockdowns, government support measures and high vaccination rates, as well as a lower impact than forecast on the younger, insured population. Most insurers have released parts of their COVID-19 reserves as a result which has boosted their profitability.

There are still risks from mental health, long-COVID conditions and the economic downturn we’re currently experiencing. The pandemic has adversely impacted mental health and it’s uncertain how long this will last. Long-COVID conditions such as joint pain, fatigue, and memory difficulties could result in a further increase in IDII claims.

Providing income support for Australians when injury or illness prevents them from being able to work not only benefits policyholders and their family but also the community more broadly. If IDII products are genuinely sustainable this will mean they are more widely available and at a more affordable price. Sustainability will only be achieved if insurers earn sufficient revenue on their capital.

Therefore, the return to profitability for IDII is a positive sign for its sustainability. The insurance industry will need to remain disciplined with its product design and pricing to achieve the right balance between sustainability and profitability.

Please do not hesitate to contact the Insurance & Risk team at Hewison Private Wealth if you have any questions regarding personal insurance.

Source: https://www.apra.gov.au/news-and-publications/idii-back-on-track

Please note: The advice provided is general information only. Individuals should seek specialised advice from a qualified financial adviser before acting on any general advice. Past performance is not a reliable indicator of future performance. Read more about your privacy HERE: