With only four weeks left until the end of the 2022-23 financial year, it is timely for trustees and members of Self-Managed Super Funds to take stock of your superannuation arrangements and ensure you have done everything you should do to maximise your retirement benefits.

So, with this in mind, here are five tips for you to consider:

(1) Maximise your contributions

Concessional Contributions

The maximum concessional contribution you can make this year is $27,500…so if you want to boost your super and your employer contributions are below this figure, you could put extra funds into your super as a personal concessional contribution. Not only will you boost your super balance, but you can use your personal contribution as a tax deduction as well.

For those with less than $500,000 in superannuation on 30 June 2022, you may be able to deposit more into your super fund. If you have not used all your concessional contributions cap in previous years, you can carry forward your unused contributions and make them this year. For those likely to go over the $500,000 limit in the coming financial year, it is a good idea to check if you can utilize these arrangements, as it may be the last year you can do it.

Non-concessional contributions

You can deposit $110,000 of personal money (or assets) into your superannuation fund this year as a non-concessional contribution. You can also put up to $330,000 into your superannuation fund by bringing forward two future years of personal contributions into the current year.

Care needs to be taken that your super balance is below $1.7 million and that you don’t need to meet any work test to make these contributions if you are under 75 years of age.

(2) Minimum pension payments

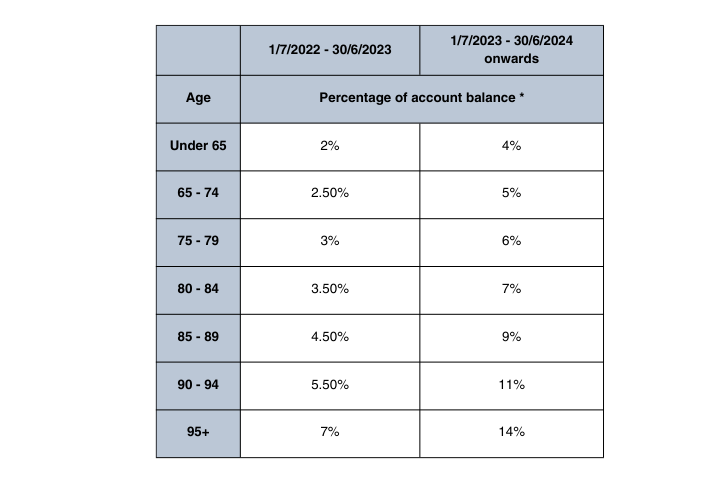

If you are drawing a pension from your superannuation fund, then you must make sure you draw the minimum pension before 30 June. The table below sets out the minimum pension requirements for the current financial year, and also next year (note the 50% discount of the minimum pension ends on 30 June 2023).

(3) New limits mean new options

From 1 July 2023, the total super balance cap rises from $1.7m to $1.9m. This has implications for those contributing to super as well as those wanting to start a retirement phase pension. For contributors, you will be able to contribute additional funds to super if your total super balance is below $1.9m. For those wanting to maximise the amount of funds held in a retirement phase pension, you may want to delay starting your pension until 1 July 2023 (if you haven’t already started it). This will increase the amount you can put into your pension – up to the $1.9m cap rather than the current $1.7m cap. If you already have a pension in place, then you will need to seek advice as you will not receive the full increase in the transfer balance cap, only a proportional increase based on the amount of cap you still have left to use.

(4) Review your SMSF investment strategy

If it has been some time since you last reviewed the investment strategy of your SMSF, then it would be a good idea to check the strategy and ensure it is up to date.

Your SMSF auditor will be checking to see that your fund has a written investment strategy in place, and that it is up to date.

(5) Review your binding death benefit nominations

Your superannuation benefits are not automatically dealt with by your Will if you die. As a result, you need to put in place a specific nomination with your super fund to ensure your benefits are paid to the right place. A super fund death benefit nomination can only be made to benefit your spouse, your children or to your estate. By nominating your estate, your super benefits transfer to your executor and would be dealt with in accordance with the terms of your Will.

When dealing with your superannuation arrangements, it is always worth getting advice from a suitably qualified professional to ensure you are putting yourself in the best possible position. If you are needing some assistance, please book an appointment with one of our highly qualified advisers.