A large part of our role as advisers is to provide clients with guidance and clarity around whether they have accumulated enough in financial assets to finish working and retire. As the proximity to retirement approaches, this can be an incredibly daunting discussion for clients to have.

For clients who have worked with us for many years and who have steadily built their retirement base over time, there can be a higher degree of confidence – this is a key milestone we have been working towards, and their tailored plan has been well established.

For others, sudden and pivotal life events can take place that can either force or provide opportunity for an earlier retirement than originally planned (including redundancy or receipt of an inheritance). The unexpected nature of such changes often increases financial anxiety.

Many of us work as employees and are accustomed to receiving a consistent income throughout a 30–40 year career, which is accompanied by a level of financial security through the regularity of these payments. Understandably, it can be a psychological challenge to confidently feel there is a big enough nest egg to provide for the dream holidays, social outings, family gifts and regular expenses for the remaining days.

And this can be an extensive funding period. For a 60-year-old Victorian man, recent life expectancy rates suggest retirement may need to be funded for close to 25 years and for women, this is over 27 years. Statistically, many will outlive these average timeframes, so it is important to ensure that your money will last for an extended period, so you do not risk outlasting your funds.

So, how much money is needed?

If you own your home, an industry rule of thumb is that retirees will typically spend around two thirds of their pre-retirement salary each year. This usually covers most expenses; however, it won’t factor in the additional spend that generally occurs in the first few years (at least) of retirement – the dream European holiday/s, or the home renovation that has been on the to-do list for many years. These expenses will need to be additionally factored in.

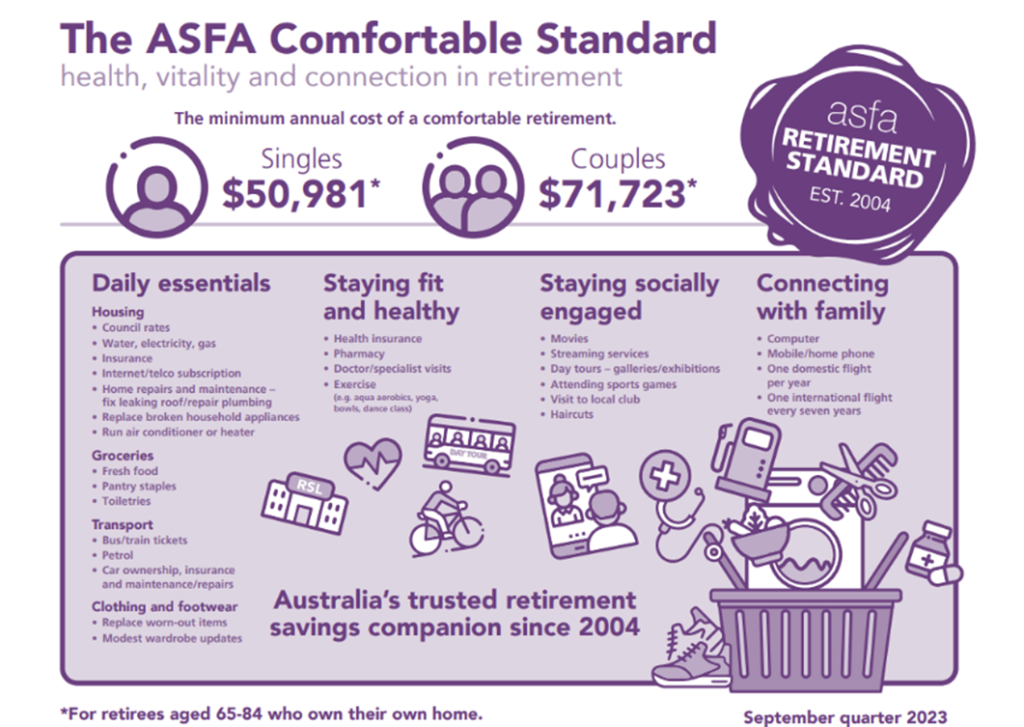

The Association of Super Funds of Australia (ASFA) regularly surveys retirees to better understand retirement spending patterns and produce their ‘Retirement Standard’ as part of this research.

For homeowner retirees aged 65-84, current research suggests that a couple will need around $72,000 in annual income for a ‘comfortable’ lifestyle. As you can see below, while this factors in one domestic flight per year and one international flight every seven, for many retirees this may limit the ‘bucket list’ goals and additional income will be required to fund the dream retirement that many have been working so hard towards. So, for some, this target income level may then be closer to $100,000 in the initial retirement years.

Assuming your capital is invested well, you should be able to achieve an income return of approximately 4-5% p.a. on average over the long-term, and ideally you would grow your capital base in addition to offset inflationary pressures.

Using the above 4-5% income rate, a couple would initially require approximately $2m – $2.5m in combined investment capital to produce $100,000 in retirement income. Capital growth in addition would help to preserve the capital base over time. We generally find this is a key goal of many families who want to preserve their hard-earned wealth and provide this to benefit future generations or philanthropic purposes.

While helpful to lead initial thinking, it is important to note that the above is a simplistic rule of thumb and does not consider the sequencing of events (e.g. holidays every second year, a one-off large purchase such as a car, or a potential house downsize in future), and it also does not take into consideration Government support, such as the Age Pension.

When working with clients individually, we have an in-depth discussion about short and long-term goals to provide a more precise and bespoke calculation of their own retirement funding needs.

There are many simple calculators available online to assist people with better understanding how they are tracking towards their retirement goals. A good example can be found here. And while there is no one simple answer as to how much is needed for retirement, Hewison’s Director, Partner and Wealth Adviser, Glenn Fairbairn will guide you in working out ‘your’ magic figure in his previous blog.

Of course, money and expenditure is never the same across any week, month or year and differs significantly between everyone individually. What you want to do in retirement and the level of money required is deeply personal and is closely aligned with your personal beliefs and values.

Early planning and preparation is key to feeling financially confident – it is never too early to start thinking about your goals and dreams for life after work.