On 17th April, the price of gold reached its highest historical value in nominal terms, trading at AUD$3,724.50 per ounce. This represents a significant increase over the past 12 months (approximately 24% up) and speculation remains regarding how high this can continue to grow.

The price of gold depends on several factors, including the level of supply available on the market, interest rates, inflation sentiment and monetary policy.

Why invest in gold?

There are a number of reasons why people may choose to invest in gold and precious metals:

Ways to invest in gold

There are a variety of ways to have exposure to gold as an investment. Options include:

Gold as an inflationary hedge

In traditional portfolio management, gold has been widely viewed and used as a hedge against inflation. Recent research however suggests that the price of gold won’t always rise in the face of inflation or broader economic uncertainty. A key example of this is the 1980s, where the price of gold varied significantly from the level of inflation in the US (investors lost 10% on average from 1980 to 1984 in gold compared with an annualised inflation rate of 6.5%). From 1988 to 1991, annual inflation averaged about 4.6%, whereas gold prices fell approximately 7.6% p.a. on average.

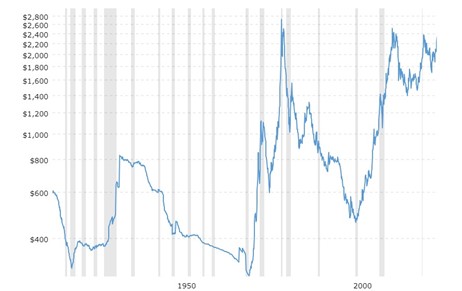

While viewed as a relatively stable investment, gold prices have fluctuated dramatically over the past 100 years, as demonstrated in the chart below:

Gold prices in USD – 100 Year Historical Chart (Source: Macrotrends.net)

As you can see, gold prices have had some significant changes over the past few decades, including lows in the 1970s and all-time highs in the 1980s. In recent years, gold has nominally reached even higher, but interestingly when adjusted for inflation, the early 1980s remains the peak time for gold.

Gold Vs Shares

While gold can be viewed as a hedge against inflation, so too can other growth assets, including shares. Recent research has shown that if you invested USD$100 into gold and USD$100 into the S&P 500 since the gold standard was released in 1972, your initial investment in gold would be worth around USD$4,500 compared with USD$18,500 in the S&P500 (assuming dividends were reinvested along the journey).

Summary

The evolution of ETFs has made it simpler to gain exposure to investments in precious metals, such as gold. While interesting to understand, gold does not regularly feature or form a part of our recommended portfolios due to the volatile nature of the price movements and the lack of income paid for the investment. While historically viewed as a strong hedge, recent data is emerging conflicting with this view, and results have suggested that the sharemarket can provide a smoother journey and historically stronger outcomes for investors.